In today’s consumer-driven society, it can be easy to confuse wants with needs. We are bombarded with advertisements and messages telling us what we should have and what we should desire. However, it is important to understand the distinction between our wants and our needs in order to make better financial decisions and live a more fulfilling life.

Needs are essentials for survival and well-being, such as food, shelter, and clothing. Wants, on the other hand, are things that we desire but are not necessary for our basic needs. It is crucial to prioritize our needs over our wants in order to live a balanced and sustainable lifestyle.

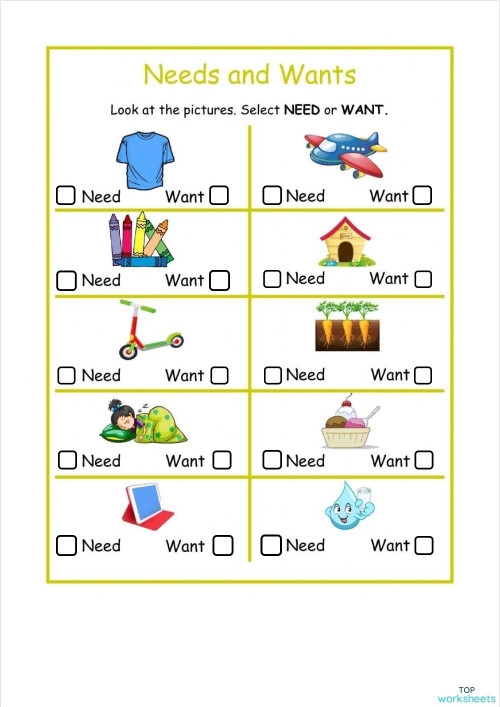

Wants vs Needs Worksheet

One way to differentiate between wants and needs is by using a wants vs needs worksheet. This worksheet can help individuals identify their needs and wants, prioritize them, and make informed decisions about their spending habits.

The worksheet typically includes a list of items or expenses and asks individuals to categorize them as either wants or needs. By going through this exercise, individuals can gain a better understanding of their spending patterns and make adjustments accordingly.

It is important to remember that everyone’s wants and needs will vary depending on their individual circumstances and priorities. What may be a want for one person could be a need for another. The key is to be honest with yourself and prioritize your needs over your wants in order to achieve financial stability and peace of mind.

By regularly revisiting the wants vs needs worksheet and reassessing your priorities, you can make better financial decisions and live a more intentional and fulfilling life. It is a valuable tool for budgeting, goal-setting, and overall financial planning.

In conclusion, understanding the difference between wants and needs is essential for making smart financial choices and living a more conscious life. By using a wants vs needs worksheet, individuals can gain clarity on their priorities and make informed decisions about their spending habits. It is a simple yet powerful tool that can help us achieve financial stability and peace of mind.