When starting a new job, one of the forms you will likely be asked to fill out is the W-4 form. This form is used by your employer to determine how much federal income tax to withhold from your paycheck. Understanding how to fill out the W-4 worksheet correctly is important to ensure that you are not overpaying or underpaying your taxes.

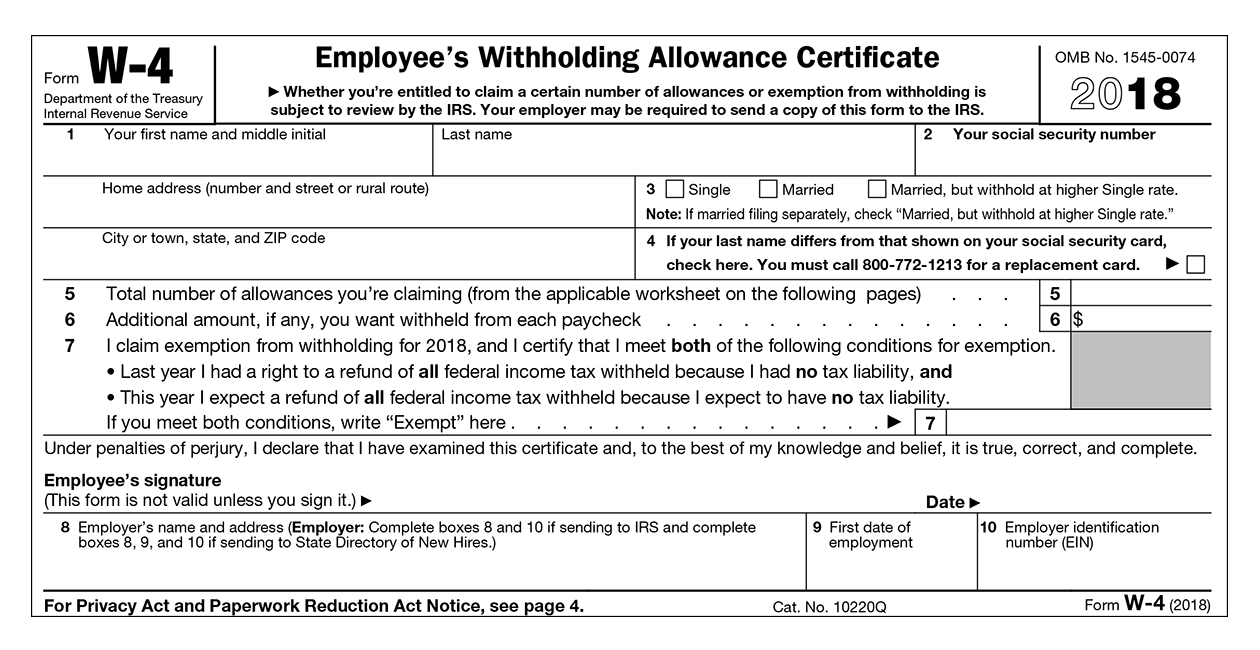

The W-4 form may seem intimidating at first, but it is actually quite straightforward once you break it down. It includes sections for your personal information, such as your name, address, and Social Security number, as well as sections where you can indicate your filing status and any additional income or deductions you may have.

W-4 Worksheet

The W-4 worksheet is a crucial part of the form that helps you calculate the number of allowances you should claim. The more allowances you claim, the less tax will be withheld from your paycheck. However, claiming too many allowances can result in owing taxes at the end of the year.

When filling out the worksheet, you will need to consider factors such as whether you are married, have children, or have multiple jobs. These factors can affect the amount of tax you owe and the number of allowances you should claim. It is important to review your W-4 form regularly, especially when your financial situation changes.

If you are unsure about how to fill out the W-4 worksheet, you can use the IRS’s online withholding calculator to help you determine the correct number of allowances to claim. This tool takes into account your income, deductions, and credits to provide you with an accurate withholding amount.

Remember that it is always better to be safe than sorry when it comes to taxes. If you are unsure about how to fill out the W-4 worksheet or have any questions about your withholding, it is best to consult with a tax professional. They can help you navigate the complexities of the tax system and ensure that you are withholding the correct amount from your paycheck.

In conclusion, understanding the W-4 worksheet is essential for managing your tax withholdings effectively. By taking the time to fill out the form accurately and reviewing it regularly, you can avoid any surprises come tax time. If you ever have any doubts or concerns about your W-4 form, don’t hesitate to seek guidance from a tax expert.