When it comes to planning for retirement, understanding how Social Security benefits are taxed is crucial. The amount of Social Security benefits that are taxable depends on your total income for the year. To determine if your benefits are subject to taxation, the IRS provides a worksheet known as the Social Security Taxable Benefits Worksheet.

This worksheet helps you calculate the taxable portion of your Social Security benefits based on your income. It takes into account not only your Social Security benefits but also other sources of income such as wages, self-employment income, and dividends.

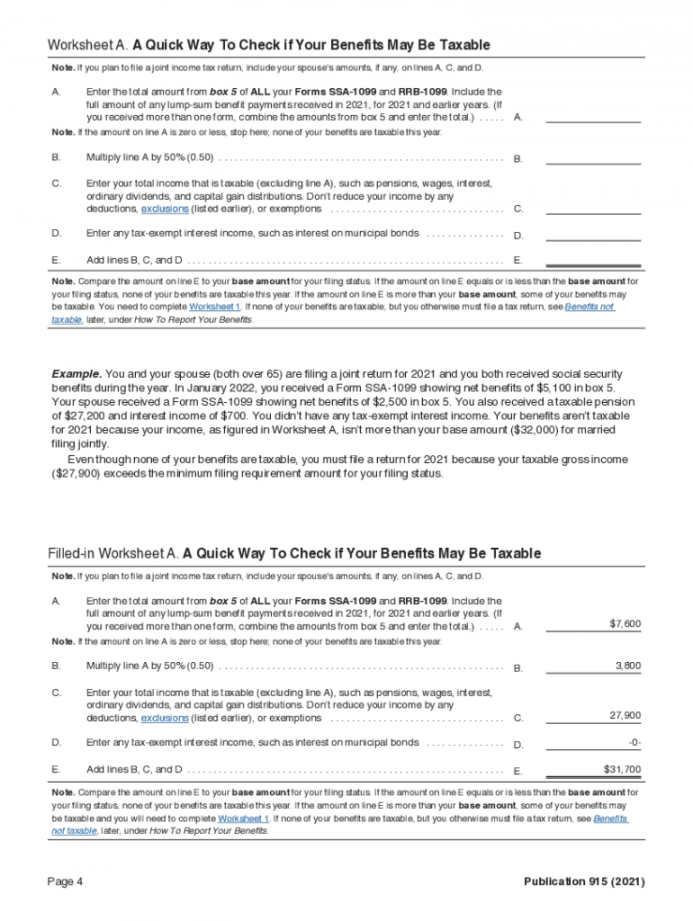

Social Security Taxable Benefits Worksheet

The Social Security Taxable Benefits Worksheet consists of a series of steps that guide you through the process of calculating the taxable portion of your benefits. You start by determining your provisional income, which includes half of your Social Security benefits plus all other sources of income. The worksheet then helps you calculate the percentage of your benefits that are subject to taxation based on your filing status and income level.

Once you have completed the worksheet, you will know how much of your Social Security benefits are taxable for the year. This information is important for tax planning purposes, as it can help you avoid any surprises when it comes time to file your tax return. By understanding the rules for taxing Social Security benefits and using the worksheet to calculate the taxable amount, you can better plan for your retirement income needs.

It’s important to note that not all Social Security benefits are subject to taxation. If your income is below a certain threshold, your benefits may not be taxable at all. However, if you have a higher income, you may owe taxes on a portion of your benefits. The Social Security Taxable Benefits Worksheet is a valuable tool for determining how much of your benefits will be taxed and can help you make informed decisions about your retirement finances.

In conclusion, the Social Security Taxable Benefits Worksheet is an essential tool for retirees to determine the taxable portion of their Social Security benefits. By following the steps outlined in the worksheet, you can calculate the amount of your benefits that are subject to taxation and plan accordingly. Understanding how your benefits are taxed can help you make informed decisions about your retirement income and ensure that you are prepared for any tax implications.