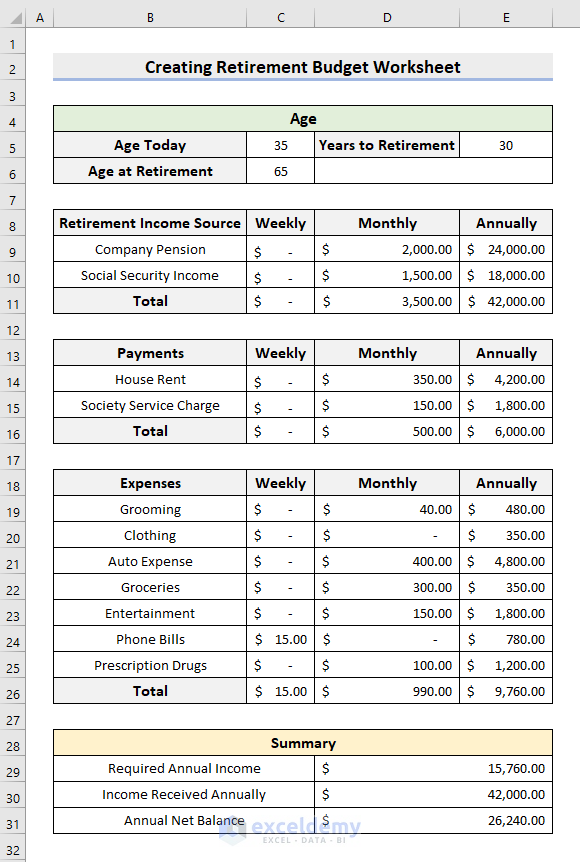

As retirement approaches, it is essential to have a clear understanding of your finances and how you will manage them during this new phase of life. Creating a retirement budget worksheet in Excel can be a helpful tool to organize your expenses, track your income, and ensure that you are financially prepared for the future.

One of the key benefits of using Excel for your retirement budget worksheet is its versatility and customization options. You can easily create categories for all of your expenses, including housing, transportation, healthcare, entertainment, and more. By inputting your income sources and expenses, you can quickly see where your money is going and make adjustments as needed to meet your financial goals.

Another advantage of using Excel for your retirement budget worksheet is the ability to easily update and modify the document as your financial situation changes. You can track your expenses on a monthly basis, compare your actual spending to your budgeted amounts, and make adjustments as necessary to stay on track with your financial goals.

Additionally, Excel offers a variety of tools and functions that can help you analyze your financial data and make informed decisions about your retirement budget. You can create charts and graphs to visualize your spending habits, use formulas to calculate your savings rate or retirement income projections, and even set up alerts to notify you when you are approaching your budget limits.

Overall, creating a retirement budget worksheet in Excel can provide you with a clear picture of your financial situation, help you make informed decisions about your retirement planning, and ensure that you are financially prepared for the future. By taking the time to set up and maintain a budget in Excel, you can feel confident that you are on track to achieve your retirement goals.

In conclusion, using Excel to create a retirement budget worksheet can be a valuable tool in ensuring your financial security during retirement. By organizing your expenses, tracking your income, and making informed decisions about your finances, you can set yourself up for a comfortable and stress-free retirement. Start planning today and take control of your financial future!