Keeping track of your finances is essential for managing your money effectively. One way to ensure that you are staying on top of your expenses and income is by balancing your checkbook regularly. By using a checkbook worksheet, you can easily track your transactions and make sure that your account is accurate.

Managing your finances can be overwhelming, but with the right tools and strategies, it can be a simple and effective process. Balancing a checkbook worksheet is a practical way to monitor your spending habits, avoid overdraft fees, and ensure that you have enough funds to cover your expenses.

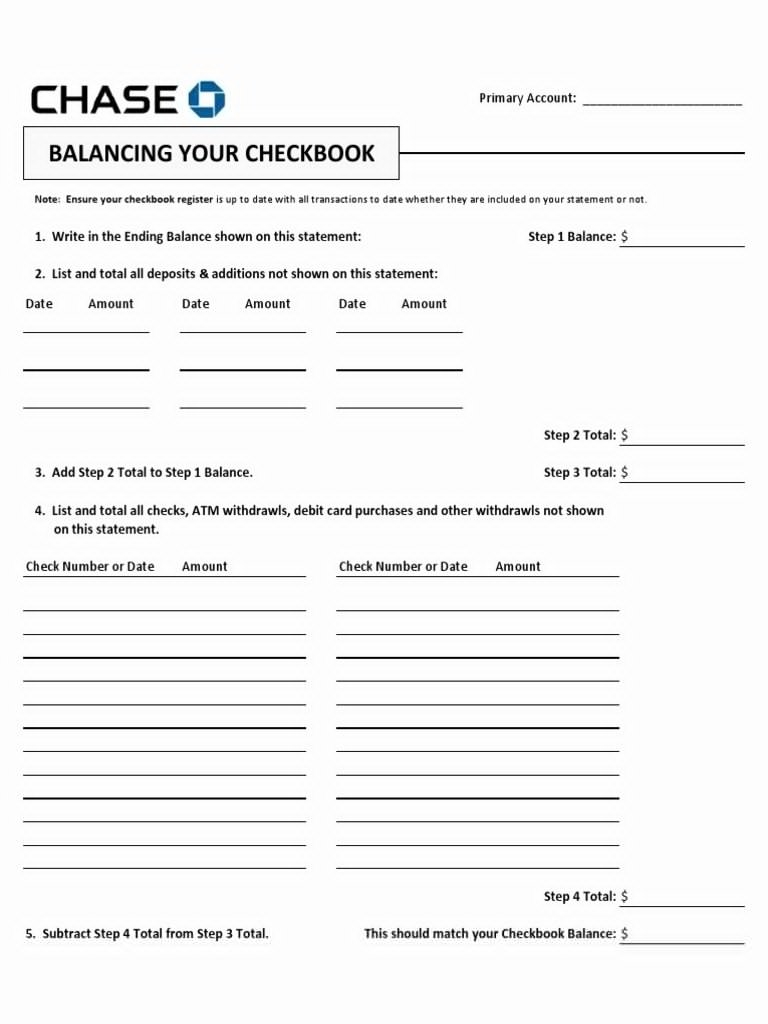

Balancing a Checkbook Worksheet

To balance your checkbook using a worksheet, start by recording all of your transactions, including checks, deposits, and withdrawals. Make sure to include the date, description, and amount for each transaction. Next, compare your records with your bank statement to ensure that everything matches up. If there are any discrepancies, investigate and correct them immediately.

It’s important to update your checkbook worksheet regularly, ideally on a weekly or monthly basis. This will help you stay organized and prevent any errors or oversights. By consistently tracking your finances, you can identify any patterns or trends in your spending habits and make adjustments as needed.

Another tip for balancing a checkbook worksheet is to categorize your expenses, such as groceries, utilities, and entertainment. This will give you a better understanding of where your money is going and help you create a budget that aligns with your financial goals. Additionally, consider setting aside a small amount each month for savings or emergencies.

In conclusion, balancing a checkbook worksheet is a practical and effective way to manage your finances and stay on top of your spending. By recording and tracking your transactions, comparing them with your bank statement, and categorizing your expenses, you can ensure that your account is accurate and avoid any financial pitfalls. Remember to update your worksheet regularly and make adjustments as needed to keep your finances in check.