As the end of the year approaches, many companies prepare their financial statements for the year-end. One crucial document that helps in this process is the December 31 worksheet. This worksheet contains important information about the company’s financial position and performance for the year.

It serves as a summary of all the company’s financial activities throughout the year, including revenues, expenses, assets, and liabilities. Analyzing this worksheet helps the company’s management and stakeholders to evaluate the company’s financial health and make informed decisions for the upcoming year.

Components of a Company’s December 31 Worksheet

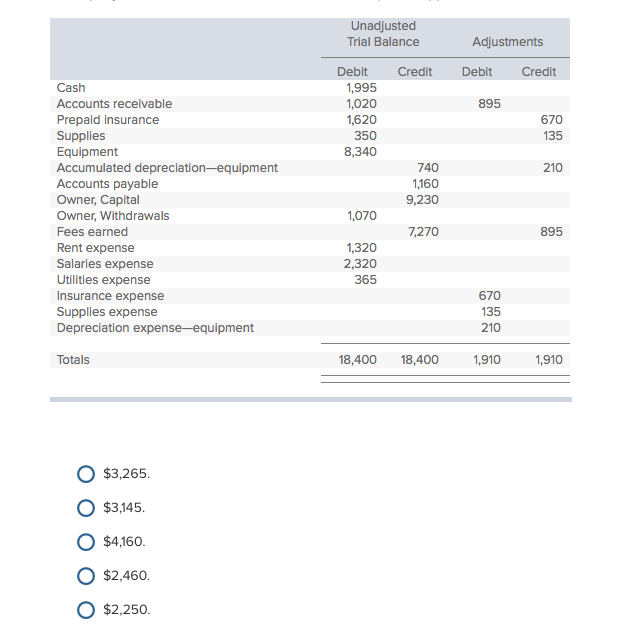

The December 31 worksheet typically includes a trial balance, adjustments, adjusted trial balance, income statement, balance sheet, and closing entries. The trial balance lists all the accounts and their balances before adjustments are made. Adjustments are then made to ensure that the financial statements accurately reflect the company’s financial position.

Once adjustments are made, an adjusted trial balance is prepared, which is used to create the income statement and balance sheet. The income statement shows the company’s revenues and expenses for the year, while the balance sheet provides a snapshot of the company’s assets, liabilities, and equity at the end of the year.

Closing entries are then made to transfer the temporary account balances to the permanent accounts, preparing the books for the next accounting period. This process ensures that the company starts the new year with accurate financial records and a clean slate.

By analyzing the December 31 worksheet, stakeholders can gain insights into the company’s financial performance, identify areas for improvement, and make strategic decisions for the future. It serves as a valuable tool for assessing the company’s profitability, liquidity, and overall financial health.

Overall, the December 31 worksheet plays a crucial role in the year-end financial reporting process for companies. It provides a comprehensive overview of the company’s financial activities for the year and helps in assessing its financial position and performance. By understanding and analyzing this worksheet, companies can make informed decisions and set financial goals for the upcoming year.