When it comes to managing your finances, staying organized is key. One way to keep track of your income and expenses is by using a worksheet for W4. This tool can help you monitor your earnings, deductions, and withholdings, making it easier to file your taxes accurately.

Whether you’re a freelancer, a small business owner, or an employee with multiple sources of income, having a W4 worksheet can streamline the process of calculating your tax liability and ensuring compliance with tax laws.

Here are some key components to include in your W4 worksheet:

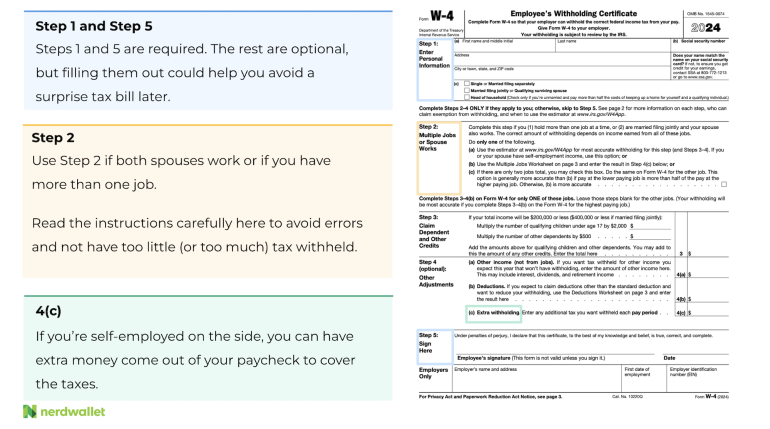

1. Personal Information: Start by entering your name, address, Social Security number, and filing status. This information is crucial for identifying your tax return and determining your tax bracket.

2. Income Sources: List all sources of income, including wages, salaries, bonuses, dividends, and interest. Make sure to differentiate between taxable and non-taxable income to avoid any discrepancies.

3. Deductions and Credits: Keep track of any deductions and credits you qualify for, such as mortgage interest, student loan interest, and retirement contributions. These can help lower your taxable income and reduce your overall tax liability.

4. Withholdings: Calculate the amount of federal and state taxes withheld from your paychecks to ensure you’re on track with your tax payments. Adjust your withholdings if necessary to avoid owing a large sum at tax time.

By using a worksheet for W4, you can stay organized and informed about your financial situation throughout the year. This tool can help you make better decisions when it comes to budgeting, saving, and planning for the future.

Overall, a W4 worksheet is a valuable resource for anyone looking to take control of their finances and ensure compliance with tax laws. By keeping accurate records of your income, deductions, and withholdings, you can avoid costly mistakes and maximize your tax savings.